Money Management For Occupational Therapy

“You must gain control over your money, or the lack of it will forever control you.”

Dave Ramsey

Want to know the best strategy for teaching your O.T. clients about money management? This technique is a simple way to teach individuals with Autism, ADHD, and anxiety how to budget and manage their money.

You will learn the importance of setting financial goals, how emotions drive spending behavior, how to evaluate past financial decisions, and how to create a simple budget to get started. As a female with ADHD, I have found this method efficient for my spending and budgeting.

After learning these money management strategies, you will feel confident helping your clients and inspired to create your budget, giving you financial freedom.

This post is all about money management in Occupational Therapy.

Money Management for Occupational Therapy

Budgeting and money management can be daunting, so I’d recommend completing these steps over several O.T. sessions.

1. Reflection Questions for Money Management

There are no right or wrong answers to these reflection questions, but it’s a great way to gain insight into behavior and self-awareness.

I’d encourage them to imagine the best-case scenario and respond with their deepest desires to plan for the life they dreamed of.

You don’t have to answer all of these, but here are 18 self-reflection questions to get started:

- Are you more of a saver or a spender?

- How much debt do you have?

- How much do you need in savings to feel comfortable and secure?

- Was money openly discussed in your household growing up?

- When you reflect on your life in your older age, what will be your most significant accomplishments and defining moments?

- Do you prefer to eat out or cook at home?

- Are you okay with thrifted clothes, or do you prefer brand-new ones?

- What type of life, health, vision, dental, rental, homeowners, etc. insurance do you need?

- What mode of transportation will you use to get from one place to another?

- How many vacations per year do you plan on taking?

- How much do your hobbies cost?

- What is your current housing situation? Do you live alone or with roommates?

- Do you plan on owning a townhome, condo, cabin, tiny home, mobile home, or home one day?

- What do you want your wedding to look like if you get married?

- How many children would you like to raise?

- Will someone stay home with your children, or will they attend daycare until they are old enough to go to school?

- Are you going to help your kids pay for college or trade school?

- At what age would you ideally like to retire?

2. Identify Emotions Associated With Money

Emotions drive behavior, which is why it’s essential to understand one’s emotions about money and how they impact spending, saving, and budgeting behaviors.

Here are some emotions commonly felt with money management.

Reassure them that there are no right or wrong answers.

If you are familiar with the Zones of Regulation curriculum, this is an excellent opportunity to incorporate evidence-based practice into the activity.

Green Zone

The Green Zone is when we feel most productive and focused.

For example, some identify as a “morning bird,” “night owl,” or a “permanently exhausted pigeon.”

- Confident

- Content

- Inspired

- Successful

Blue Zone

The Blue Zone is characterized by low energy and moving slowly.

- Ashamed

- Depressed

- Guilty

- Inferior

Yellow Zone

The Yellow Zone occurs when there is some control but energy levels are heightened.

- Anxious

- Inadequate

- Overwhelmed

- Vulnerable

Red Zone

The Red Zone is a sensation of feeling out of control and highly heightened energy levels.

- Critical

- Jealous/Envy

- Neurotic

- Powerful

3. Understand the Difference Between Wants & Needs

Needs are essential for survival and are necessities to live and work.

Physiological and safety needs are at the bottom of Maslow’s hierarchy of Needs, which indicates that they must be addressed first.

An individual must feel safe and cared for to build a solid foundation for intellectual and creativity.

Examples of Needs:

- Air

- Child care

- Clothing

- Employment

- Food

- Property

- Shelter

- Sleep

- Transportation

- Water

Wants are not essential for survival but make life more comfortable and enjoyable.

Therefore, wants can be considered splurges and weaknesses.

Examples of Wants:

- Dining or take-out restaurants

- Going to the movies

- Fashionable clothes

- Gifts

- Car gadgets

- Latest upgraded cell phone

- T.V. subscriptions

- Gym memberships

- Seasonal home decor

- Manicures and pedicures

- Vacations

- Amazon orders

Individuals with ADHD struggle with impulse control, so it’s crucial to identify and create a plan.

If you or your client struggle with impulse control, DO NOT get a credit card.

Credit cards can be a dangerous cycle brought on by instant gratification and “carefree” spending.

High interest rates (+20%) are one of the significant consequences once the credit card bill arrives in the mail.

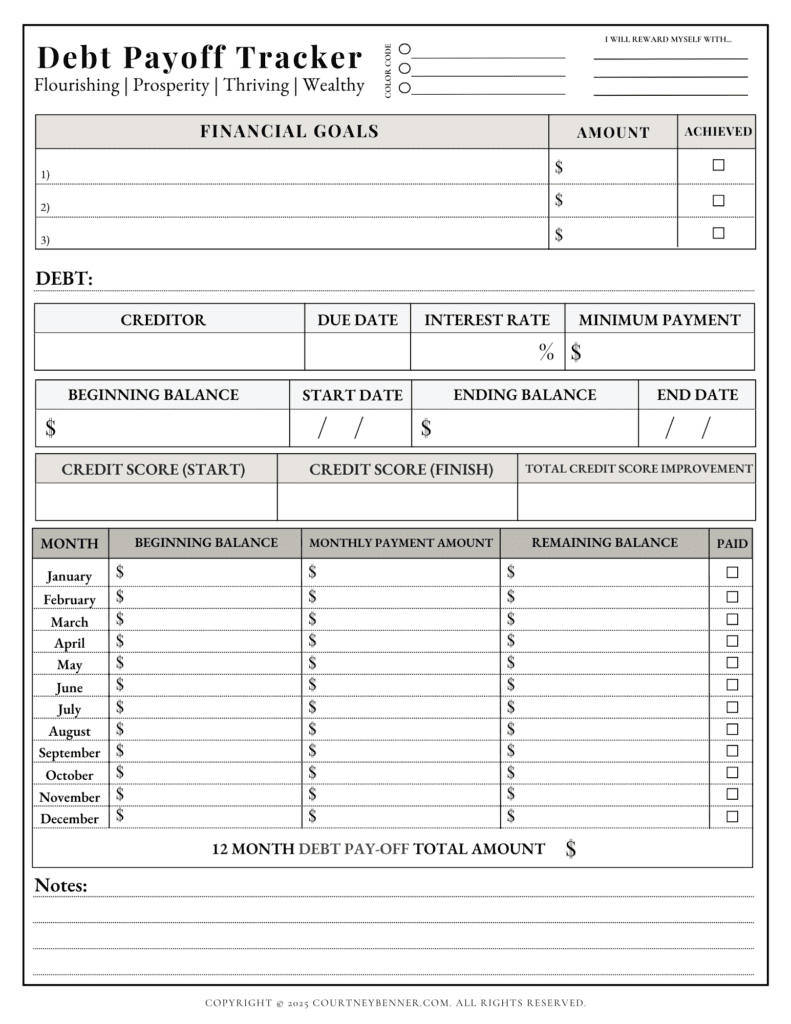

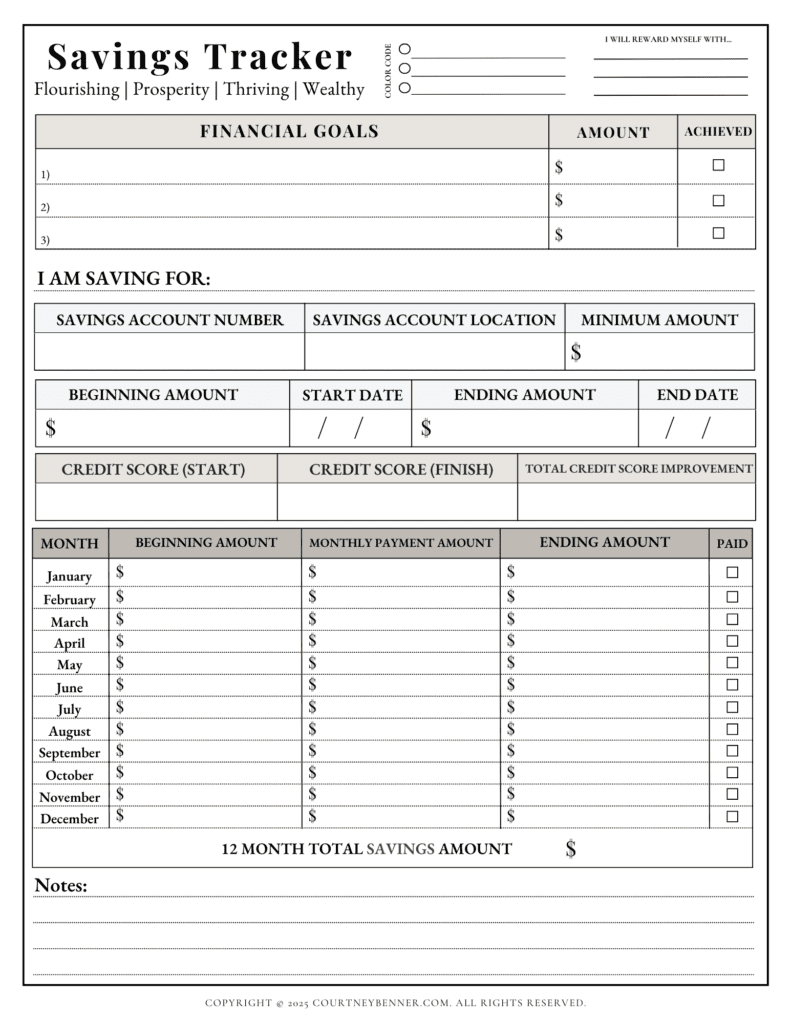

4. S.M.A.R.T. Goals

After answering the reflection questions honestly, it’s time to identify one financial goal to focus on.

Here is the formula for writing SMART goals:

S= SPECIFIC

The three common financial goals are:

Improving credit scores

Paying off debt

Saving money

Choose one specific money goal that aligns with their desired result.

M = MEASURABLE

Thankfully, financial goals are easy to measure and quantify.

However, to make goals measurable, help your client find the exact monthly number and the total end goal.

For example, saving $1,000 a month would be the end, and $100 would be the monthly amount.

A = Attainable

Is this financial goal compatible with the individual’s strengths and weaknesses regarding money?

Does it match past money behaviors?

R = REALISTIC

Does the goal align with core values and dreams?

Does it match their current life situation?

This goal should be a step forward toward achieving their financial goals and dream lives.

T = TIME

When is the anticipated date for this financial goal to be achieved?

It could be days, weeks, months, or one year.

Examples of S.M.A.R.T. Money Management Goals

- Paying off a $15,000 car payment with a minimum monthly payment of $500 in 3 years.

- Paying off $40,000 in student loans with a minimum monthly payment of $450 in 7 years.

- Calling the credit card company to reduce interest from 22% to 11% by the end of the month.

- Saving $5,000 in an emergency fund by setting aside $300 for 16 months.

- Save up for a $10,000 down payment for a home by saving $250 monthly in 4 years.

5. Evaluate 3 Months of Recent Bank Statements.

For this step, you will need a paper printout of the most recent bank statements and highlighters to color code and categorize.

Materials for Money Management

- 1-3 months of most recent bank statements (printed)

- Paper & writing utensils

- Several colored highlighters

- Calculator

You don’t have to use these exact colors, F.Y.I.

- Green = Income

- Blue = Rent or home

- Purple = Utilities (i.e., gas, water, sewer, electric, etc.)

- Pink = Insurance (i.e., home, life, car, etc.)

- Yellow = Food (i.e. groceries & restaurants)

- Orange = Transportation (i.e., vehicle maintenance, car insurance, bus, public transit, etc.)

- Red = Entertainment (i.e., hobbies, fun activities, vacations, etc.)

After color coding each section, add the totals and write them down on paper as you will need the amounts for the next step.

6. Use the 50/30/20 Rule.

After color-coding the bank statements, it’s time to apply the 50/30/20 rule (you can use Google to double-check accuracy).

There is no shame in using your resources. For example, “What is 20% of $3,500?”

The monthly take-home income is the leftover paycheck after taxes and other payroll deductions (i.e., health insurance and retirement).

50% for Needs

To calculate 50% of the income, divide it in half. For example, 50% of a $3,500 monthly income is $1,750.

- Mortgage and rent

- Transportation

- Child care

- Utilities

- Groceries

30% for Wants

The following two sections are for the other 50% of the income. For example, 30% of $3,500 is $1,050.

- Entertainment

- Restaurants

- Shopping

- Subscriptions

- Travel

20% for Savings or Paying Off Debt

This is the last piece of the income pie. For example, 20% of $3,500 is $700.

- Debt payments

- Emergency

- Retirement

- Savings

The 50/30/20 method doesn’t have to be perfect and exact, but it’s a great starting point.

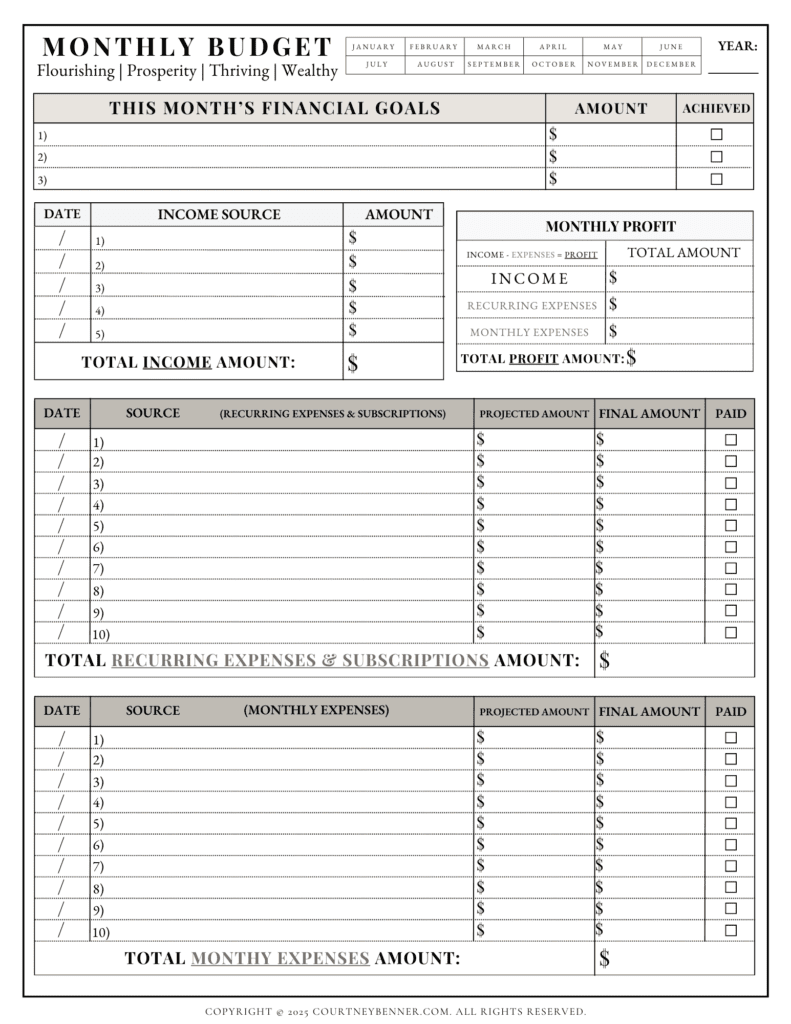

7. Create a Zero-Based Budget

The first step to creating a budget is to list every source of monthly take-home income, which is the leftover paycheck after taxes and other payroll deductions (i.e., health insurance and retirement).

Note: Some employers send paychecks on set dates every month for 24 paychecks per year, and some pay their employees every other week for 26 paychecks per year.

The second step is to write the monthly expenses (needs + wants) using the 50/30/20 rule.

The third step is to identify the due dates. Finally, you can enroll in auto-payments if the client struggles with memory and organization skills.

The fourth step is to subtract the income from the expenses.

The fifth step is to analyze if there is more income than expenses or vice versa.

If there is more income than expenses, the leftover money can go towards the S.M.A.R.T. goal.

If there are more expenses than income, trim the wants list until it balances out to zero.

8. End-of-Month Money Management Reflection

At the end of the month, you can help the client reflect on how the budget did or did not work for them.

- Was some progress made toward the one financial goal?

- Does the budget need to be adjusted?

- Did anything unexpected happen this month?

- What is one thing you learned this month from the budget created?

- What can you do better going forward?

FREE Printable Money Management Activities

Sign up for my newsletter and receive these FREE printable money management printables for budgeting, paying off debt, and saving money.